Minnesotans exhausting unemployment benefits in higher numbers

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

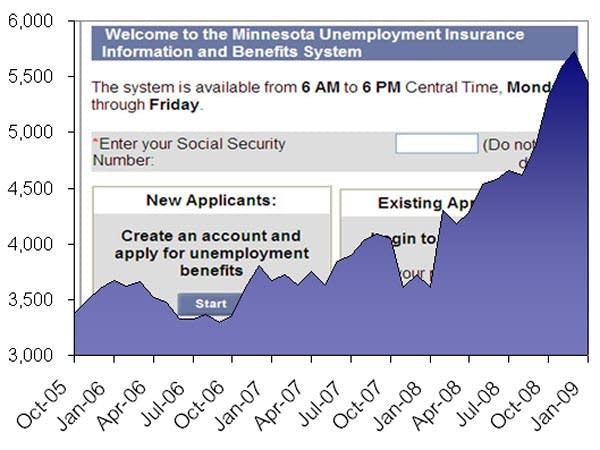

As state job losses accelerate, Minnesotans are applying for jobless benefits a rate of more than 1,000 a month.

"So we're seeing huge numbers," said Lee Nelson, the chief attorney for the state's unemployment benefits program.

Nelson said this quarter, Minnesota has more people on unemployment than in any other quarter in the state's history. And the number of people who exhaust or use up all their benefits is also skyrocketing.

Benefits cap out at 26 weeks or half a year. Nelson said people usually don't burn through all that time, but now, about 40 percent of them do just that.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

"What it means is that people aren't returning to work like they used to," Nelson said.

And that's because of the tight job market.

But the safety net has gotten bigger. About 90 percent of Minnesotans whose unemployment insurance ran out anytime after May 2007 would qualify for a federal extension of up to 33 weeks.

Those who burn through that could get another 3 months of unemployment.

Add it all up and jobless Minnesotans could pull in almost a year and a half of unemployment insurance.

For St. Paul resident Mary Gallagher, it's a huge relief to know the money will keep flowing. She has a $1,000 mortgage payment and a 19-year-old daughter at home.

"There was a time about three weeks ago, when I checked online with the unemployment benefits, and saw that I was down to less than $800 remaining in the account," Gallagher said.

Gallagher lost her job last August doing social work for elderly people. And, while her benefits were due to run out this week, she found out she'll continue to get her weekly distribution of $325.

"I am eligible for a federal extension of up to 20 weeks, and I really hope not to need 20 weeks," Gallagher said.

Gallagher would much rather be working, but she's not seeing many jobs she's qualified for. She's taking a computer class at St. Paul College to try to spiff up her skills and regularly works on assignments in the computer lab.

She said she'll keep living off unemployment and credit cards until she finds more work.

But for those who fall outside the safety net, the financial pain is clear.

Across town in a suburban diner, John Hulett explained how he lost his job in July 2007 and exhausted his benefits later that year. He said he checked online to see if qualified for the new extensions.

"It showed that I qualify for zero benefits, and that was it," Hulett said.

Hulett said his unemployment is rough on his family. His wife can't find more than part-time work, and they're supporting two daughters in college. He's doing some master's level work in theology and his student loans help pay the bills. But the family has nearly lost the house a few times, and Hulett's marriage has suffered.

"When you can't bring home something as basic enough to cover food, your spouse begins to look at you as what is the point of you being here," Hulett said. "You can't even contribute to the basics there."

Hulett's hoping that he made a mistake in filling out the unemployment benefits form. He'd be thrilled if an extension did come through.

But what would help Hulett would cost the state. According to Lee Nelson, the state's head unemployment benefits attorney, Minnesota paid out a whopping $45 million in jobless benefits and extensions the week before last.

"[It] may be the largest amount ever paid in the history of the unemployment insurance program in any single week," Nelson said.

And, Nelson said those payouts will likely continue increasing by about a $1 million a week.