Banks and consumers increasingly use text alerts to fight fraud

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

Every time there is a transaction on his Wells Fargo debit card, Richard Davies-Doku receives a text message on his mobile phone, whether he's here at the Mall of America or anywhere else.

For Davies-Doku, of Minneapolis, the messages bring peace of mind. If a thief uses his card or account number to buy something, he would know.

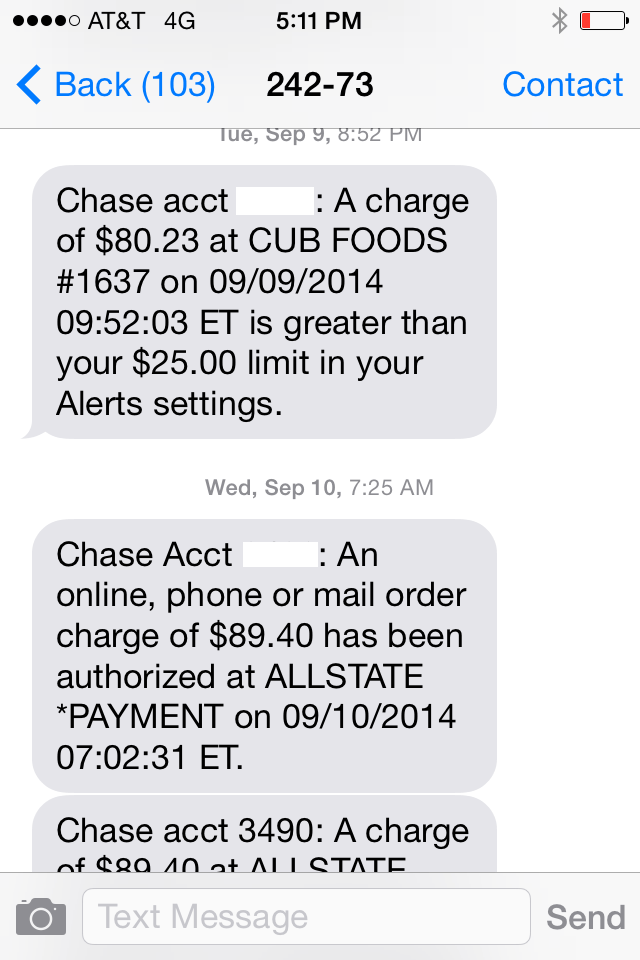

"Anyone does anything on my card, it'll tell me immediately," he said. "It shows you exactly what the transaction is. If someone's in Old Navy using my card right now, it would alert me, let me know, for example, you spent $29.99 at Old Navy."

With cyber-crooks grabbing credit and debit card numbers by the tens of millions, there is growing interest among consumers in fraud alerts sent to their smartphones and other devices. After all, no one knows better than a cardholder if a purchase is legitimate.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

The alerts can arrive in a matter of seconds.

Given a heads-up alert, consumers may be able to scuttle unauthorized purchases. They certainly can detect the first time their cards are compromised or block online transactions before products are shipped.

Generally, cardholders have to choose to receive such missives. Banks are wary of sending uninvited messages, in part because that can rack up charges on someone's mobile phone bill. That's kept a lid on adoption.

A survey done last year by Javelin Strategy & Research found 27 percent of shoppers had received a digital account alert within the past 30 days. At U.S. Bank, an estimated 23 percent of customers received such alerts; 26 percent of Wells Fargo customers did. Leading the industry were Citibank, 41 percent; Chase, 44 percent; and Bank of America, 45 percent.

With the theft of account information and card fraud so much in the news these days, consumers are showing more interest in learning if anyone is messing with their money.

"In 2013, we witnessed a record number of consumers becoming victims of existing card fraud," said Al Pascual is a fraud and security analyst for Javelin Strategy and Research. "Just short of five percent had either their existing credit card or debit card accounts misused. We think a lot of that is actually being driven by data breaches."

Javelin estimates fraud on consumer cards cost $11 billion in 2013, with the average fraud amounting to about $1,400. Cardholders spent an average of nine hours to resolve the mischief done by crooks.

Pascaul said the value to both consumers and banks is likely to fuel adoption of alerts that come via email, text message and banking apps for smartphones.

"It saves the financial institutions money," he said. "They no longer have to have someone calling me, asking me whether or not I committed a transaction. It saves me grief potentially. Maybe maintains the relationship, too. If I'm a fraud victim and my bank doesn't tell me, then I might take issue with that."

Most banks and credit unions offer alerts free of charge. Those from the biggest banks tend to be fast and sophisticated.

And they work.

"Who's better to know that a transaction is fraudulent than the consumer?" asked Stephanie Ericksen, Visa's vice president of risk products.

Visa provides the technology behind the alerts of 140 banks. Those institutions fire off about 3 million alerts a month to customers. Customers decide what transactions they want flagged, such as online or foreign purchases or transactions over $50.

Ericksen said the payment card industry is very adept at spotting and stopping fraud, limiting it to 6 cents for every $100 of transactions. Alerts augment those efforts, but banks have not revealed how much.

"The added benefit of giving the consumer control does help prevent some additional fraud and also gives the consumer greater peace of mind," she said.

Some companies' messages are far from immediate. Alerts for Target's Visa cards, for instance, take at least a day to go out after a transaction takes place. Target officials say the retailer is working to speed up notifications.

US Bank sends alerts within seconds of a transaction. The bank touts the option in its marketing.

"We've had customers say to us, 'My friend got an alert. I want that, too,'" said Christine Hobrough, US Bank's regional market manager for the Twin Cities. "So, they are a draw. We all care about our money. We work hard for it. And this helps. This really creates a partnership with the bank."

With cybertheft on the rise, those partnerships are likely to continue growing in number.

"The bad guys are getting very, very good at being bad," said David Robertson, publisher of the Nilson Report, which tracks the payment card industry. "Having the cardholder participate in the protection of the system is an important thing to do."

He said that's especially the case with debit cards. With credit cards, it's a bank's money that's at risk. But with a debit card, Robertson notes it's a consumer's money at risk.

"I would definitely recommend that a consumer sign up for debit card alerts because you can put the kibosh on fraudulent transactions far quicker," he said.