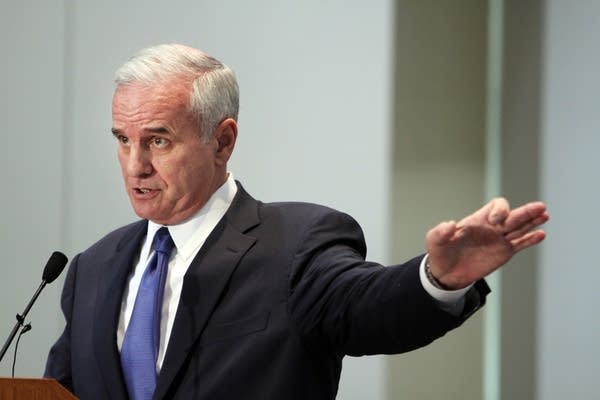

Dayton, GOP to square off over proposed tax hikes

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

Gov. Mark Dayton is proposing far more tax increases than spending cuts in his plan for erasing a projected $6.2 billion state budget deficit. The Democratic governor unveiled a two-year, $37 billion budget Tuesday that he says keeps his campaign promises and protects the middle class.

Dayton proposed an income tax hike on Minnesota's top earners, which would give the state the second-highest state income tax rate in the country.

But the governor's budget sets up a sharp conflict with Republican legislative leaders, who say the budget should be balanced exclusively by cutting government spending.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

View Dayton's budget proposal presentation with annotations from MPR reporters.

Dayton said his proposal is not ideal, but he challenged his critics to try to do better.

"I'm not willing to make barbaric cuts in the essential services that affect peoples lives," said Dayton Tuesday morning. "Others who want to go deeper into cuts than I propose will have to justify their decisions, and especially justify to Minnesotans why they would choose to cut funding to support middle-income families or lower-income Minnesotans, while protecting the top income people in this state from paying a single dollar more in income taxes."

Dayton's proposal would add a fourth tier to the state income tax, as well as create a temporary surtax.

The new top rate would be 10.95 percent and apply to single filers with a taxable income of more than $85,000, single head of household filers with a taxable income of more than $130,000 per year and couples with a taxable income of more than $150,000 a year after deductions. There would also be a temporary 3 percent income surtax for those earning more than $500,000.

The combination of the two would make Minnesota's income tax rate 13.95 percent, which would be the highest in the country. Currently, Hawaii, California and Oregon have higher income tax rates than Minnesota.

Dayton's proposal also creates a state property tax on homes valued at more than $1 million.

Assuming Dayton follows current practice, the higher tax rates would be applied to the portion of a person's income above the thresholds. Likewise, the property tax would be applied to the portion of the home's value over the $1 million threshold.

Dayton emphasized that only 5 percent of Minnesota households will be affected by the income tax hike.

"This is a feeble and pathetic attempt at going back in time, to raise taxes and increase spending in order to balance a budget. It will not work."

Dayton, who is an heir to his family's department store fortune, called on the state's top earners to do their part in helping solve a dire financial situation.

"This is about restoring tax fairness in Minnesota and it's about asking our most affluent citizens to help us out at this time," Dayton said. "We're in one of the worst financial situations in the country."

But Republican leaders promised to fight any tax increases, setting up the debate on how to plug the budget deficit by the time the new fiscal year starts on July 1.

House Speaker Kurt Zellers, R-Maple Grove, said Republican and Democratic governors across the nation are making deep spending cuts and avoiding tax increases. Zellers said he's disappointed with Dayton's approach.

"This is a feeble and pathetic attempt at going back in time, to raise taxes and increase spending in order to balance a budget. It has not worked. It will not work," said Zellers.

According to the left-leaning Center for Budget and Policy Priorities, Minnesota has one of the largest budget shortfalls by percentage in the country.

Dayton proposed cuts to higher education, health and human services and would reduce the state government work force by 6 percent, or about 772 full-time equivalent workers.

Long-term care and community-based services will see cuts, and 7,200 adults on MinnesotaCare will lose their state-subsidized health insurance.

The University of Minnesota and the Minnesota State Colleges and University system would see a 6 percent cut.

Dayton is proposing more money for early childhood and K-12 education, including $33 million to expand all-day kindergarten and $19 million for other programs such as an achievement gap innovation fund.

Dayton is keeping funding for the state's teacher pay-for-performance initiative, QComp, but isn't increasing funding for the program created under former Gov. Tim Pawlenty.

Dayton would continue the recent tradition of delaying payments to school districts for a savings of about $1.4 billion, but he proposed paying back the accounting shift starting in two years.

The governor also wants to protect aid to counties and cities, funding local government aid at $3.5 billion in the next two years. It's more than what cities and counties are currently getting because of cuts Pawlenty made.

Dayton argued that restoring the aid would prevent property tax increases seen in recent years.

When including the delayed payment to school districts, Dayton's budget raises more than $4 billion in revenue while making $950 million in permanent cuts. The total budget for the biennium is about $37 billion.

Zellers and Senate Majority Leader Amy Koch, R-Buffalo, said Republicans will not accept the $37 billion total pricetag. Instead, they say spending should not go above the $32 billion in revenue that's expected to come in.

"We're not going to be promising on things that we can't keep," said Koch. "We're going to be looking very realistically at things. We're going to do some really good reforms, some really good prioritizing, but keep it within the $32 billion that we have."

Republicans are expected to release their budget proposal by March 25.

"We think there is plenty of room to negotiate and prioritize," Koch said.

DFL minority leaders praised Dayton's budget, but they stopped short of pledging to vote for his proposed tax increases. Still, Senate Minority Leader Tom Bakk, DFL-Cook, said Dayton delivered on his key campaign pledge.

"He said that he thinks everyone in the state should pay the same percentage of their income in taxes, and his proposal does that. So, anybody that's outraged I think wasn't listening to Gov. Dayton on the campaign trail, and he did win," said Bakk.

Besides a tax hike for the wealthiest Minnesotans, Dayton also proposes raising revenue through surcharges on hospitals, doctors and clinics that care for people on the federal Medicaid program, and through provider rate increases. Both measures will raise $877 million over two years.

Creating another income tax tier will raise about $1.9 billion permanently, and the temporary surtax on those making more than $500,000 will raise an additional $918 million. The property tax for million-dollar homes raises $84 million.

Dayton and Republican leaders will travel the state separately Wednesday, to pitch their competing budget messages.

Dayton has stops planned in Duluth, Moorhead, Mankato and Rochester. Republicans will hit the same cities in reverse order, following a morning kickoff event in St. Paul.

Discuss the Dayton's budget release on Facebook

(MPR reporter Tom Scheck contributed to this report.)